In the realm of stock investment, a well-known electric vehicle company has emerged: Lucid Motors. Recently, Shinsegae Group Vice Chairman Jeong Yong-jin stirred up buzz by posting a photo of Lucid on social media. Jeong was the first domestic customer to purchase a Tesla Model S and played a key role in bringing the first store to Starfield Hanam.

The company behind Lucid is Lucid Motors, which recently agreed to merge with Churchill Capital SPAC, as reported by Bloomberg. Lucid is expected to go public soon, with a projected valuation of $24 billion. In the past month, foreign investors have reportedly purchased shares worth $95.08 million.

The electric vehicle currently under production at Lucid Motors, the Lucid Air, boasts an impressive 0 to 60 mph time of just 2.5 seconds. Unveiled last September, this premium electric vehicle can travel 510 miles on a single charge.

The vehicle features LG Energy Solution's 21700 cylindrical batteries, which have a capacity 50% higher than traditional 18650 batteries. The all-wheel-drive (AWD) version accelerates from 0 to 60 mph in 2.5 seconds, producing a peak output of 1,080 horsepower.

The design is also notable, featuring a drag coefficient of 0.21, resembling that of a jet aircraft. The design team stated that they drew inspiration from the canopy and fuselage of airplanes. The vehicle incorporates cutting-edge technology within a robust aluminum frame, topped with a canopy-like roof.

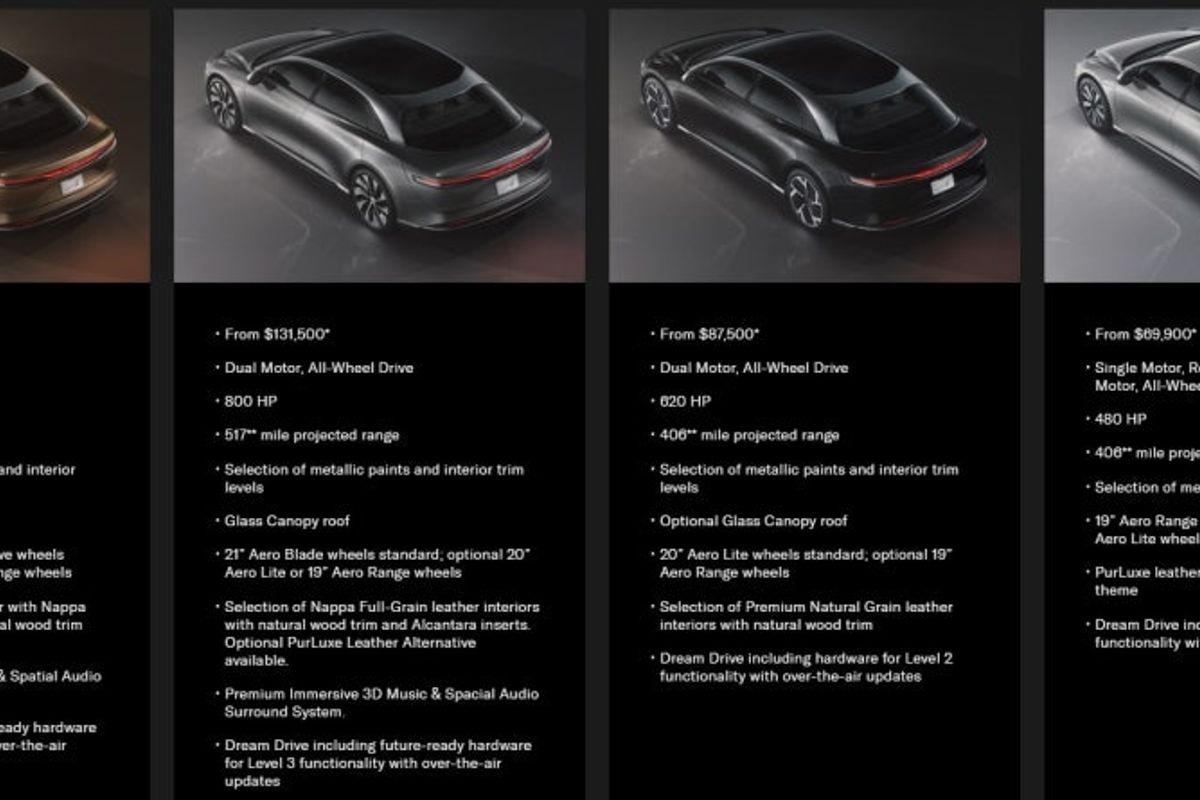

The Air Pure model offers 480 horsepower at a price of $69,900 The Air Touring model delivers 620 horsepower for $87,500

The Air Grand Touring produces 800 horsepower at $131,500 The Dream Edition boasts 1,080 horsepower for $169,000

Lucid's charging system is currently being developed through the Electric Vehicle Infrastructure Project. Lucid vehicles will offer one year of free charging at Electric Vehicle Infrastructure stations. The charging system operates at 900V/350kW, supporting ultra-fast charging.